Different Options for Taking Payments at Fairs and Fests

The moment has come. A customer has approached your booth, picked out a favorite product, and has made the decision to buy it. You can feel the excitement of making a sale start to rise until, they pull out their credit card and you’re not prepared to take it. The good news is you can avoid this with some inexpensive and easy to use systems for taking credit cards.

The Big 3

There are many options out there when it comes to getting setup with a credit card reader, but we recommend checking out Square, PayPal, and SparkPay for their ease of use and cost effectiveness.

Setup and hardware for all three companies are relatively similar. Each requires you to sign up for a free account, and then they’ll send you a free credit card reader that plugs directly into the headphone jack of your smartphone or tablet.

Square

Square is one of the most widely used tools for taking credit card payments in person. In fact, they were the first to the game. They’re widely used and trusted by merchants worldwide for their reliability and ease of use.

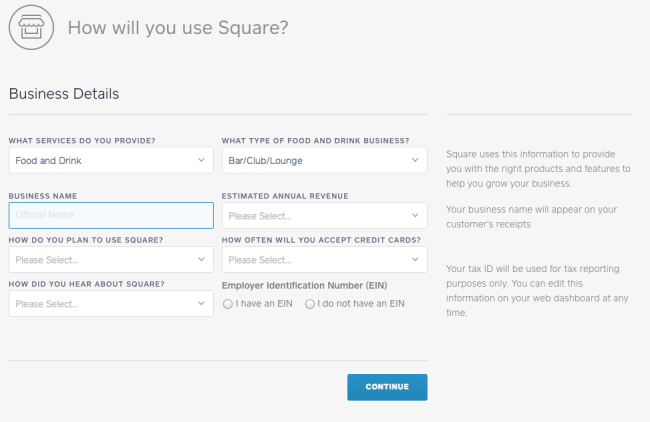

Signing up:

Signing up for your account is pretty painless and can be done rather quickly. You will need to provide information about your business, like what type you are, an estimated number of transactions you will do, and your EIN number (this is not required). Square doesn’t perform a background check which makes the process very quick and everyone is accepted.

They also allow you to track sales by giving you access to your full sales history. Very helpful!

Fees:

It’s completely free to sign up for a Square account, but they’ll charge you 2.75% on every swiped transaction you process using their reader. If you manually enter the card, it’s a bit more expensive at 3.5% plus .15 per transaction. Funds are then automatically sent to your bank account every two business days. If you’re a larger business, you can also contact them about custom pricing.

PayPal Here

PayPal Here is a bit newer to the game, but offers just about the same type of service through their credit card swiper. The main difference here is that funds are automatically deposited into your PayPal account, instead of your back account, which means you have immediate access to those funds if you have a PayPal debit card.

Signing Up:

If you already have a PayPal account, signup is an absolute breeze as they already pre-fill all of the information needed. From start to finish, I was ready to start accepting payments in under two minutes.

Fees:

PayPal fees are just a bit cheaper than Square at 2.7% with an identical 3.5% plus .15 for each manually entered credit card transaction.

SparkPay

SparkPay is newer, but still a solid option for taking mobile payments.

Signing Up:

SparkPay is run by CapitalOne and, for this reason, the signup feels a bit more serious. Signing up for SparkPay takes longer than both Square and PayPal, and you will need to provide your SSN, but like the others, it’s relatively painless and no credit check is required.

Fees:

SparkPay is different because they offer two different pricing plans for their product. You can pay $9.95 a month and enjoy a 1.95% per swipe transaction fee, or use their free monthly plan and pay a 2.7% per swipe fee. If you’re a larger business with more transactions, paying the $9.95 flat fee may be beneficial and save you money in the long run.

Keeping your offline and online inventory in sync

One of the best parts of also taking payments through a service like Square or SparkPay is that through an integration with StitchLabs you can keep your offline and online inventory perfectly in sync. In short, when you sell an item at an offline event your Storenvy store will automatically be updated! No more overselling or time spent after a show making sure your online inventory is correct. For more information about connecting StitchLabs with Storenvy through Square or SparkPay please check out www.stitchlabs.com

All in all, these are three great options for taking mobile payments, and they all offer free plans so you can take credit cards at your next event. I’ve personally used all three of them and feel they’re pretty interchangeable. I’d recommend downloading the apps for each, and use them to see what you like best. Also make sure to ask around what other vendors are using and what their experiences have been.

Bottom line, with these options you should never have to turn away a customer again.